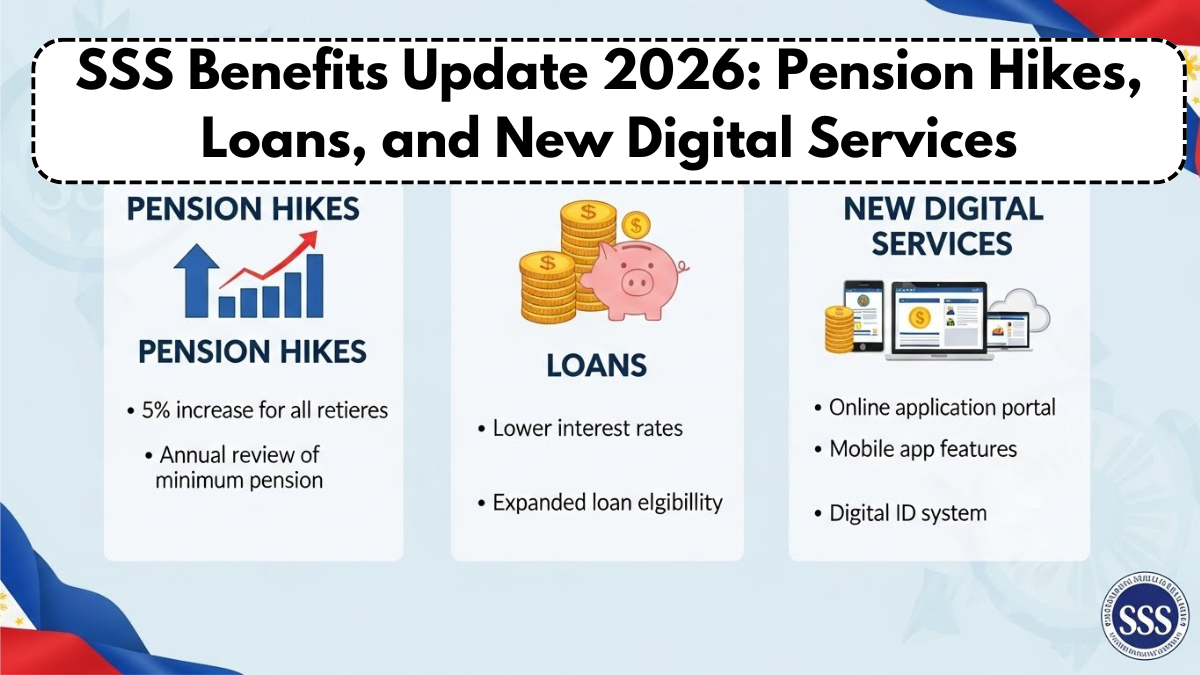

The announcement of the SSS benefits update 2026 has become a major point of interest for millions of members who rely on the Social Security System for long-term financial security. With inflationary pressures, rising healthcare costs, and an aging population, social protection programs must evolve to remain effective. The SSS benefits update 2026 focuses on strengthening retirement support through a proposed SSS pension hike, improving accessibility via expanded digital services, and modernizing benefit delivery systems. These changes aim to ensure that members receive timely, adequate, and transparent support throughout different stages of life, reinforcing confidence in the social security framework.

Why SSS Benefits Are Being Updated in 2026

The motivation behind the SSS benefits update 2026 lies in shifting economic and demographic conditions. Longer life expectancy means pensioners depend on benefits for extended periods, while younger workers expect seamless, technology-driven service experiences. Rising costs of living have also placed pressure on fixed incomes, increasing calls for an SSS pension hike. To address these realities, the system is balancing financial sustainability with improved member support. At the same time, expanding digital services reflects the need to reduce administrative delays and make transactions more convenient. Together, these measures position the SSS benefits update 2026 as both a social and technological reform.

Key drivers for the update include:

- Rising cost of living affecting retirees

- Increased demand for higher SSS pension hike

- Member expectations for faster digital services

- Need for long-term sustainability of benefits

SSS Pension Hike and Its Impact on Retirees

A central feature of the SSS benefits update 2026 is the planned SSS pension hike, aimed at improving the purchasing power of retirees. Pension increases help offset inflation and rising healthcare expenses, ensuring that older members can maintain a basic standard of living. While the exact adjustment varies depending on contribution history and retirement age, the intent is to provide more equitable and predictable income. The SSS pension hike is structured to reward consistent contributions while preserving fund stability. For retirees, this enhancement represents tangible relief and reinforces the value of long-term participation under the SSS benefits update 2026.

The table below summarizes expected benefit improvements:

| Benefit Area | Current Structure | Update Direction in 2026 |

|---|---|---|

| Monthly pension | Fixed baseline | Gradual SSS pension hike |

| Disbursement method | Mixed channels | Digitally streamlined |

| Processing time | Variable | Faster turnaround |

| Member access | Office-dependent | Expanded digital services |

These improvements highlight how financial and service upgrades work together.

Expansion of Digital Services for Members

Another major pillar of the SSS benefits update 2026 is the expansion of digital services. Members increasingly prefer online access for contributions, loan applications, benefit claims, and account monitoring. Enhanced digital services reduce the need for in-person visits, saving time for both members and administrators. Features such as real-time contribution tracking, online pension inquiries, and automated notifications improve transparency. By strengthening digital services, the system ensures that benefits, including those linked to the SSS pension hike, are delivered more efficiently. This digital shift is essential to the long-term success of the SSS benefits update 2026.

Loans, Accessibility, and Member Support

Beyond pensions, the SSS benefits update 2026 also emphasizes broader member support through improved loan accessibility and service integration. Salary and emergency loans are critical safety nets during financial hardship, and digital processing shortens approval timelines. By integrating loans into upgraded digital services, members can manage finances more proactively. These changes complement the SSS pension hike by supporting members not only in retirement but also during working years. The holistic approach ensures that the SSS benefits update 2026 addresses both short-term needs and long-term security.

Institutional Oversight and System Readiness

The implementation of the SSS benefits update 2026 is overseen by Social Security System, which manages contributions, benefits, and service delivery nationwide. Institutional readiness includes system upgrades, staff training, and member education initiatives. Strengthened digital services enhance accountability and reduce processing errors, while structured pension adjustments support sustainable SSS pension hike implementation. Effective governance is critical to ensuring that the SSS benefits update 2026 delivers on its promises without disrupting existing benefits.

What Members Should Do to Prepare

Members can take proactive steps to maximize the benefits of the SSS benefits update 2026. Keeping records accurate, updating contact and bank details, and familiarizing oneself with online platforms ensures smooth access to benefits. Monitoring announcements related to the SSS pension hike helps retirees and near-retirees plan expenses more confidently. Active use of digital services also allows members to resolve issues faster and track benefits in real time. Preparation ensures that individuals fully benefit from the reforms introduced under the SSS benefits update 2026.

Conclusion

The SSS benefits update 2026 represents a comprehensive effort to modernize social security support through financial improvements and service innovation. By introducing a measured SSS pension hike and expanding digital services, the system aims to deliver more reliable, accessible, and adequate benefits. These updates respond to economic pressures while aligning with member expectations in a digital era. As implementation progresses, the SSS benefits update 2026 is set to strengthen retirement security, enhance service efficiency, and reinforce trust in the social protection system.

FAQs

What is included in the SSS benefits update 2026?

The SSS benefits update 2026 includes pension adjustments, service improvements, and expanded digital access for members.

Will there be an SSS pension hike in 2026?

Yes, a gradual SSS pension hike is planned to help retirees cope with rising living costs.

How will digital services improve member experience?

Enhanced digital services allow faster transactions, online claims, and real-time account monitoring.

Do members need to apply again to receive updated benefits?

Most changes under the SSS benefits update 2026 will be applied automatically, provided member records are updated.

How can members prepare for the 2026 updates?

Members should update personal details, use online platforms, and stay informed about the SSS pension hike and new digital services.

Click here to learn more