The announcement of revised post office savings scheme rates 2026 has attracted widespread attention among investors, retirees, and households that rely on safe and stable returns. Post office savings schemes have long been a trusted option for people who prefer low-risk investments backed by government assurance. With economic conditions changing and financial markets remaining uncertain, the latest interest rate revision underlines the government’s effort to balance inflation control with the need to protect individual savings. For millions of people who depend on small savings schemes for financial security, understanding the updated post office savings scheme rates 2026 is essential for effective financial planning in the coming year.

Why Post Office Savings Scheme Rates 2026 Were Revised

The revision of post office savings scheme rates 2026 is primarily driven by broader economic factors such as inflation trends, monetary policy adjustments, and changing market interest rates. When inflation rises or falls, governments often carry out an interest rate revision to ensure that savings instruments remain attractive while staying aligned with economic stability goals. If rates are too low, savers lose purchasing power; if too high, government borrowing costs increase. The revised post office savings scheme rates 2026 aim to strike a balance between these competing needs.

Another important reason for this interest rate revision is to maintain the relevance of small savings schemes in a competitive financial environment. Banks, mutual funds, and private investment products constantly adjust their offerings. To ensure post office schemes remain appealing—especially for risk-averse investors—the government periodically reviews returns. By updating the post office savings scheme rates 2026, authorities reinforce confidence in these schemes as reliable long-term investment options for households across income levels.

Key Post Office Savings Scheme Rates 2026 Explained

The revised post office savings scheme rates 2026 apply across various savings instruments, including fixed deposits, recurring deposits, monthly income schemes, and senior citizen savings options. Each product serves a different financial purpose, from short-term liquidity to long-term income security. The interest rate revision ensures that returns remain competitive while continuing to support the core philosophy of small savings—safety, predictability, and accessibility.

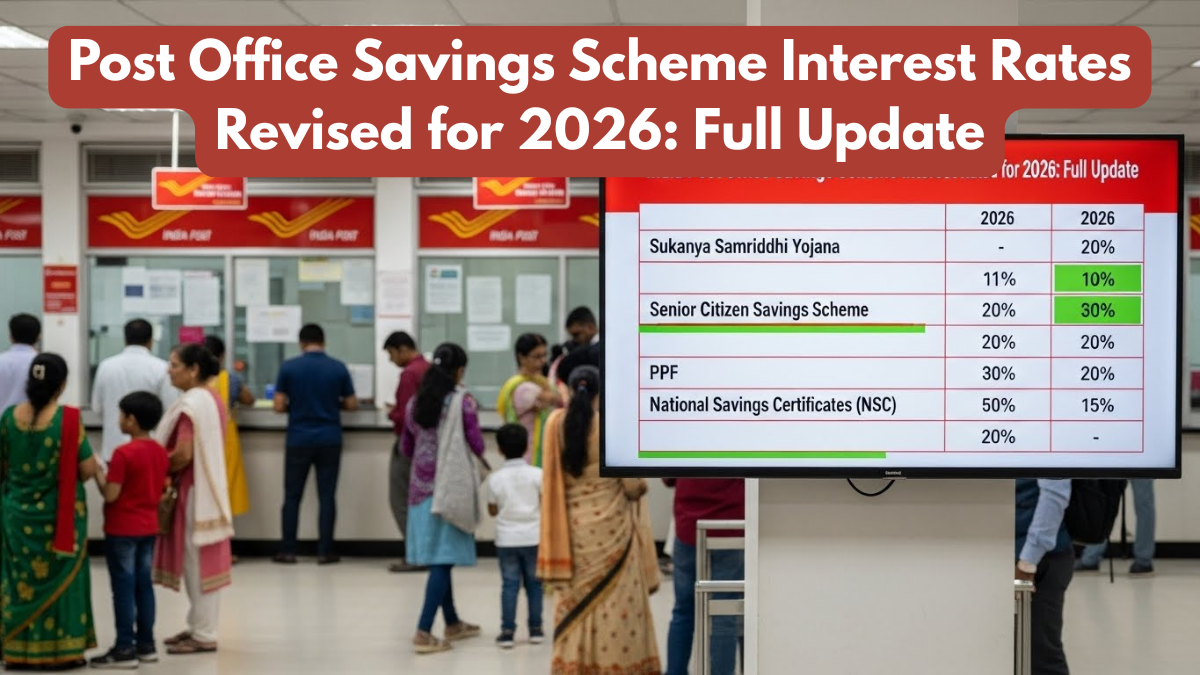

Below is a simplified table summarizing the expected structure of the revised rates for major post office savings products:

| Scheme Type | Investment Purpose | Post Office Savings Scheme Rates 2026 Impact |

|---|---|---|

| Fixed Deposit | Medium-term savings | Adjusted returns after interest rate revision |

| Recurring Deposit | Regular monthly savings | Stable growth for small savings |

| Monthly Income Scheme | Regular income | Balanced returns with safety |

| Senior Citizen Scheme | Retirement income | Attractive rates for long-term security |

| National Savings Certificates | Long-term investment | Revised rates aligned with market trends |

This table highlights how the post office savings scheme rates 2026 affect different categories of small savings, ensuring that each scheme continues to meet investor needs following the interest rate revision.

Impact of the Interest Rate Revision on Small Savers

For millions of households, small savings schemes represent financial discipline, security, and peace of mind. The interest rate revision under the post office savings scheme rates 2026 directly affects how much savers earn on their deposits. For conservative investors, even a small change in rates can significantly impact long-term returns. Retirees, pensioners, and senior citizens, in particular, rely on post office schemes for predictable income, making the revised rates especially important for their financial well-being.

The updated post office savings scheme rates 2026 may also influence how savers allocate their money. Some investors might choose longer-term instruments to lock in higher returns, while others may diversify across different small savings products to manage liquidity and income needs. By carefully analyzing the interest rate revision, savers can align their investment choices with personal financial goals such as education funding, retirement planning, or emergency savings.

How Investors Should Respond to Post Office Savings Scheme Rates 2026

Understanding and responding wisely to the post office savings scheme rates 2026 can help investors maximize benefits. The first step is reviewing existing investments to see how the interest rate revision affects maturity values and returns. Investors should compare revised post office rates with alternative options, while keeping risk tolerance in mind. For those who prioritize safety over high returns, small savings schemes remain a strong choice even after rate adjustments.

Financial experts often recommend spreading investments across multiple schemes rather than relying on a single product. For example, combining recurring deposits with monthly income schemes can provide both growth and steady cash flow. The revised post office savings scheme rates 2026 make it possible to design balanced portfolios that protect capital while generating consistent returns. Staying informed and proactive ensures that savers continue benefiting from these government-backed instruments despite changing economic conditions.

Broader Economic Significance of the Rate Revision

Beyond individual investors, the interest rate revision reflected in the post office savings scheme rates 2026 has wider economic implications. Small savings schemes play a crucial role in mobilizing household savings, which governments use to fund infrastructure, social programs, and development initiatives. By maintaining attractive rates, authorities encourage continued participation in small savings, supporting national financial stability.

At the same time, careful calibration of the post office savings scheme rates 2026 helps manage inflationary pressures and government borrowing costs. This balanced approach ensures that savers are protected without creating unsustainable fiscal burdens. The rate revision therefore reflects not only a financial update but also a strategic economic decision with long-term benefits for both individuals and the broader economy.

Conclusion

The revised post office savings scheme rates 2026 mark an important update for millions who depend on secure and reliable investment options. Through a thoughtful interest rate revision, the government has aimed to protect savers while aligning returns with current economic conditions. For those committed to small savings, these schemes continue to offer safety, predictability, and accessibility. By understanding the changes and planning accordingly, investors can make the most of the post office savings scheme rates 2026 and strengthen their financial future.

FAQs

What are the post office savings scheme rates 2026?

The post office savings scheme rates 2026 refer to the updated interest rates applied to various post office savings products following the latest interest rate revision.

Why was an interest rate revision necessary?

The interest rate revision was necessary to align savings returns with inflation trends, market conditions, and economic stability goals.

How do these changes affect small savings investors?

Small savings investors may see changes in returns, influencing long-term earnings and investment planning under the post office savings scheme rates 2026.

Should investors change their savings strategy after the revision?

Investors should review their goals and consider diversification, but post office schemes remain a safe option for small savings despite the interest rate revision.

Click here to learn more