Rising living costs, food inflation, and housing pressures have intensified calls for fairer taxation across the Philippines. In response, Philippines tax relief 2026 has emerged as a comprehensive policy direction focused on easing the financial burden on low-income households. The government’s goal is to make the tax system more progressive by ensuring that individuals with limited earnings retain more of their income for essential needs. As economic recovery continues and wage growth remains uneven, targeted tax relief is being positioned as a key tool for social and economic stability.

The Philippines tax relief 2026 measures build on earlier reforms by refining who benefits most from tax reductions and how relief is delivered. Instead of broad-based cuts that often favor higher earners, the new approach prioritizes low-income tax benefits through carefully structured deductions and exemptions. These measures are designed not only to increase disposable income but also to improve compliance and trust in the tax system. For many workers and families, the changes represent meaningful relief rather than symbolic reform.

Key Features of Philippines Tax Relief 2026 Policy Framework

At the heart of Philippines tax relief 2026 is a recalibration of income thresholds and tax brackets to reflect current economic realities. Many low-income earners have found themselves pushed into higher tax brackets over time due to inflation rather than real income growth. By adjusting thresholds, the government aims to ensure that basic wage earners are not taxed disproportionately.

Another major feature of the policy framework is the expansion of low-income tax benefits through targeted exemptions. These include higher tax-free income limits and simplified filing processes for individuals earning below a defined threshold. By reducing administrative complexity, the reforms aim to make tax relief accessible and effective. The updated framework also strengthens enforcement against avoidance while protecting vulnerable taxpayers through clearer rules and guidance.

Expanded Deductions Supporting Household Financial Stability

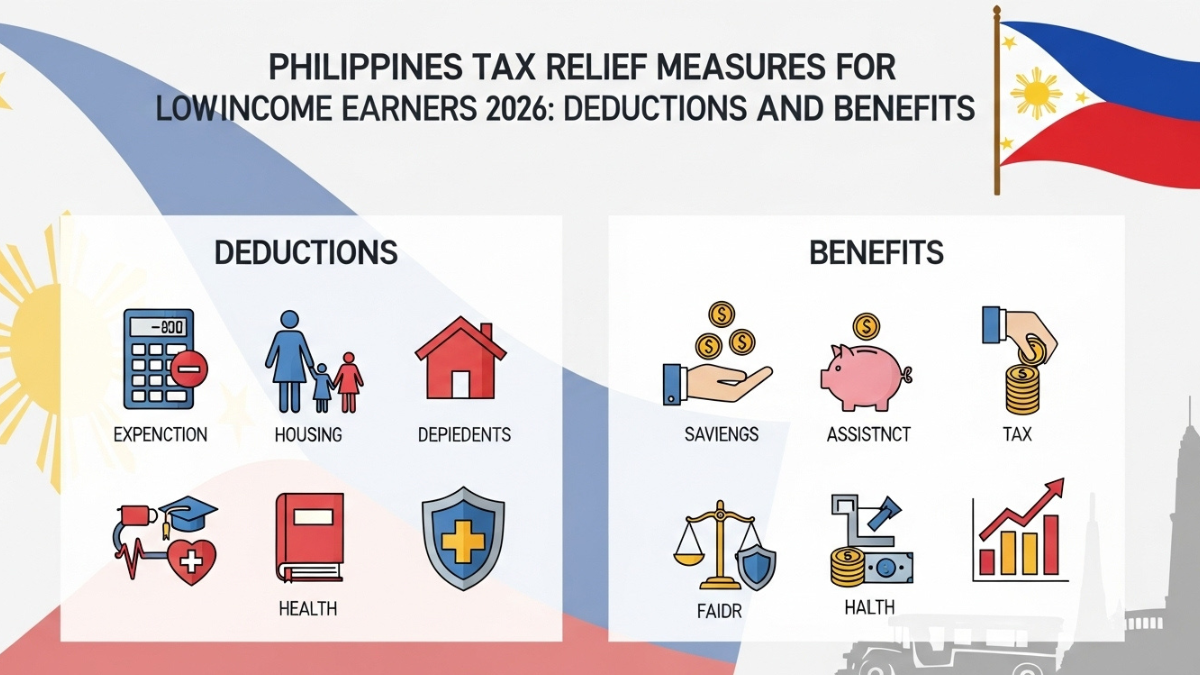

Deductions play a central role in Philippines tax relief 2026, particularly for workers supporting families or facing unavoidable expenses. The proposed measures expand allowable deductions to better reflect the real costs faced by low-income households. These deductions are intended to reduce taxable income rather than offering delayed refunds, providing immediate financial relief.

Common deduction categories expected to be emphasized include:

- Basic health and medical expenses

- Education-related costs for dependents

- Mandatory social security contributions

- Transportation and work-related expenses

By broadening access to deductions, the policy ensures that tax liability is calculated more fairly. These changes align closely with low-income tax benefits objectives, ensuring that relief reaches those who need it most. Clearer deduction rules also reduce errors and disputes, improving overall tax compliance.

How Low-Income Tax Benefits Affect Workers and Families

The introduction of enhanced low-income tax benefits under Philippines tax relief 2026 is expected to have a direct and positive impact on millions of workers. For minimum wage earners and those slightly above the poverty line, even modest tax reductions can significantly improve monthly budgets. Increased take-home pay allows families to allocate more resources toward food, education, healthcare, and savings.

The table below illustrates the general impact of tax relief measures on different income groups:

| Income Group | Previous Tax Burden | Philippines Tax Relief 2026 Impact |

|---|---|---|

| Minimum Wage Earners | Minimal relief | Expanded exemptions |

| Low-Income Workers | Disproportionate burden | Strong low-income tax benefits |

| Middle-Income Earners | Moderate | Limited targeted deductions |

| High-Income Earners | Lower relative impact | Minimal changes |

These outcomes demonstrate how Philippines tax relief 2026 is designed to prioritize equity. By focusing on deductions and targeted benefits, the reforms aim to narrow income gaps and strengthen household resilience.

Economic and Fiscal Implications of Philippines Tax Relief 2026

While Philippines tax relief 2026 is primarily a social measure, it also carries important economic implications. Increased disposable income among low-income households is likely to boost consumer spending, particularly in local economies. This spending can support small businesses, stimulate demand, and contribute to broader economic growth. From a policy perspective, targeted tax relief is often more effective than broad stimulus measures because it directs resources to those most likely to spend.

Fiscal sustainability remains a key consideration. The government must balance low-income tax benefits with revenue needs for public services and infrastructure. To address this, the reforms are expected to be paired with improved tax collection efficiency and reduced leakage. By broadening the tax base and enhancing compliance, policymakers aim to offset revenue losses while maintaining essential government functions.

Implementation Challenges and Public Awareness

Effective implementation is critical to the success of Philippines tax relief 2026. One major challenge lies in ensuring that eligible individuals are aware of the deductions and benefits available to them. Many low-income earners do not fully utilize tax relief options due to lack of information or complexity in filing procedures. Simplified forms, digital filing tools, and public education campaigns will be essential to maximize impact.

Administrative capacity is another concern. Tax authorities must process claims efficiently and consistently to maintain trust. Clear guidelines and transparent enforcement will help prevent misuse while protecting legitimate beneficiaries. Overcoming these challenges will determine whether the promised low-income tax benefits translate into real-world financial relief.

Conclusion

The Philippines tax relief 2026 initiative represents a meaningful step toward a more equitable and responsive tax system. By expanding deductions and strengthening low-income tax benefits, the reforms aim to ease financial pressure on vulnerable households while supporting economic stability. Although implementation and fiscal balance require careful management, the potential benefits for workers, families, and local economies are significant. As these measures take effect, Philippines tax relief 2026 has the potential to improve both household well-being and public confidence in the tax system.

FAQ

What is Philippines tax relief 2026?

Philippines tax relief 2026 refers to proposed tax measures designed to reduce the burden on low-income earners through exemptions and deductions.

Who qualifies for low-income tax benefits?

Low-income tax benefits are aimed at minimum wage earners and individuals below specific income thresholds set by tax authorities.

What types of deductions are included in the new measures?

Deductions may include health expenses, education costs, social security contributions, and work-related expenses.

Will Philippines tax relief 2026 reduce government revenue?

While short-term revenue may decline, improved compliance and increased economic activity may help offset losses.

How can taxpayers claim deductions under the new rules?

Eligible taxpayers can claim deductions through updated filing processes, with guidance provided by tax authorities.

Click here to learn more