GST Voucher 2026 is a crucial financial support initiative designed to help Singaporeans manage rising living costs linked to the Goods and Services Tax. As everyday expenses such as food, utilities, and healthcare continue to increase, this Singapore GST payout, eligibility update provides targeted relief to lower- and middle-income citizens. The GST Voucher scheme plays a long-term role in ensuring that tax increases do not disproportionately burden vulnerable groups. With January 2026 payouts approaching, understanding the structure, eligibility rules, and payment amounts of GST Voucher 2026 is essential for households planning their finances.

What the GST Voucher 2026 Includes

The GST Voucher 2026 consists of several components aimed at addressing different household needs. The scheme includes a cash payout for daily expenses, utility rebates for HDB households, Service and Conservancy Charges rebates, and MediSave top-ups for healthcare costs. Together, these elements ensure that the Singapore GST payout, eligibility update supports both immediate consumption needs and long-term financial security. While cash payouts offer flexibility, rebates reduce recurring bills, creating sustained financial relief throughout the year.

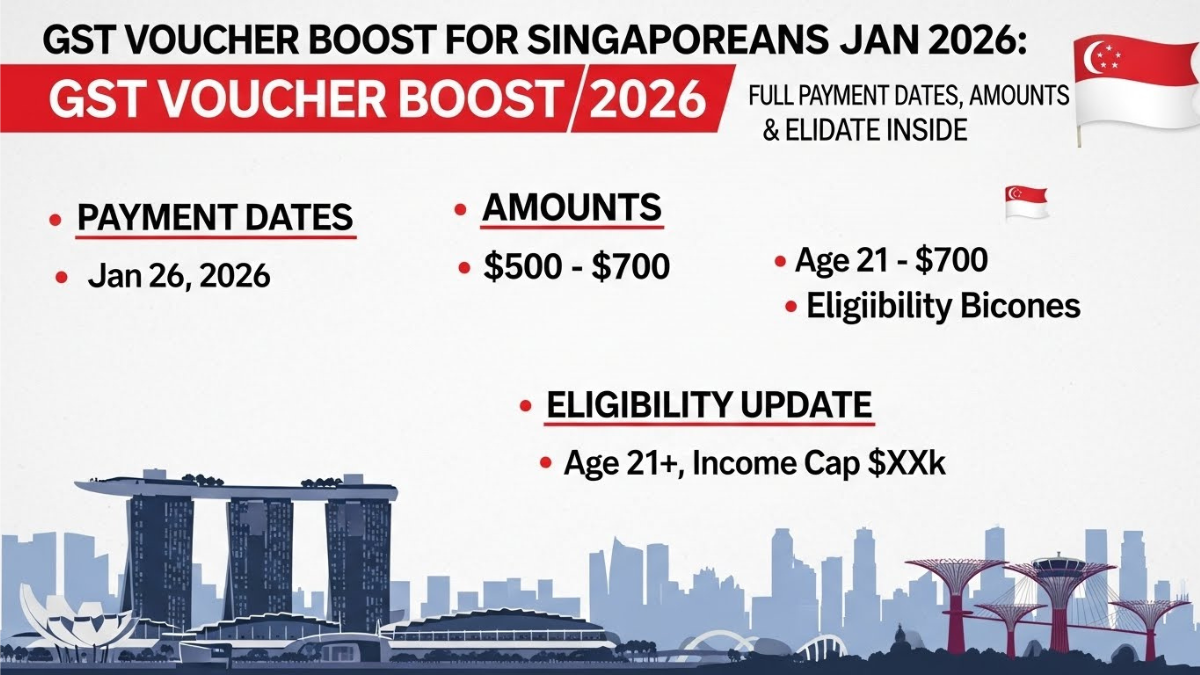

January 2026 Payment Dates and Expected Amounts

A major highlight of GST Voucher 2026 is the January payout schedule. Cash payments are expected to be credited in January 2026, providing early-year financial support when many households face post-holiday expenses. The amount received under the Singapore GST payout, eligibility update depends on income level, property ownership, and age.

| GST Voucher Component | Expected Payment Timing | Estimated Amount Range |

|---|---|---|

| GST Voucher – Cash | January 2026 | Up to S$700 |

| GST Voucher – U-Save | January, April, July, October | Varies by household |

| GST Voucher – S&CC | Quarterly | Up to several months’ rebate |

| GST Voucher – MediSave | End 2025 / Early 2026 | Up to S$450 |

This table shows how GST Voucher 2026 distributes benefits across the year, ensuring continuous household support rather than a one-time payout.

Eligibility Criteria and Key Updates for 2026

Understanding the Singapore GST payout, eligibility update is essential to determine whether you qualify for GST Voucher 2026. Generally, recipients must be Singapore citizens aged 21 or older and residing in Singapore. Assessable income thresholds apply, typically favouring individuals earning below a specified annual limit. Property ownership also plays a role, with higher benefits directed toward those owning and living in lower-value homes.

Households eligible for U-Save and S&CC rebates must occupy HDB flats and meet citizenship conditions. MediSave top-ups are usually directed at seniors to support medical expenses. These eligibility filters ensure that GST Voucher 2026 reaches citizens who are most affected by GST-related cost increases.

How to Receive the GST Voucher Smoothly

To receive GST Voucher 2026 without delays, eligible Singaporeans should ensure their personal records are accurate. Linking an NRIC to PayNow is strongly recommended, as it allows direct bank crediting of the cash payout. Those without PayNow-linked accounts may receive payments through alternative collection methods. Staying informed about the Singapore GST payout, eligibility update helps avoid missed payments and ensures full benefit access.

Why the GST Voucher 2026 Matters

The GST Voucher 2026 is more than short-term relief; it is part of a broader strategy to maintain fairness within Singapore’s tax system. By returning value to citizens through cash, rebates, and healthcare support, the Singapore GST payout, eligibility update balances revenue collection with social protection. This approach helps maintain economic resilience while protecting household purchasing power.

Conclusion

GST Voucher 2026 remains a vital pillar of financial support for Singaporeans facing rising living costs. With January 2026 payouts offering cash assistance, utility rebates, and healthcare support, the Singapore GST payout, eligibility update ensures comprehensive relief across income groups. Understanding eligibility criteria and payment schedules allows citizens to plan effectively and make the most of this support. As cost pressures persist, the GST Voucher continues to play a key role in strengthening household financial stability.

FAQs

What is GST Voucher 2026?

GST Voucher 2026 is a government assistance scheme that provides cash payouts, rebates, and MediSave top-ups to help Singaporeans offset GST-related expenses.

When will GST Voucher 2026 be paid?

The main cash payout under the Singapore GST payout, eligibility update is expected in January 2026, with other components distributed quarterly or annually.

Who qualifies for GST Voucher 2026?

Eligibility depends on citizenship, age, income level, and property ownership, as outlined in the Singapore GST payout, eligibility update.

How can I receive my GST Voucher payment?

Eligible recipients can receive GST Voucher 2026 directly through PayNow-linked bank accounts or alternative approved payment methods.

Click here to learn more