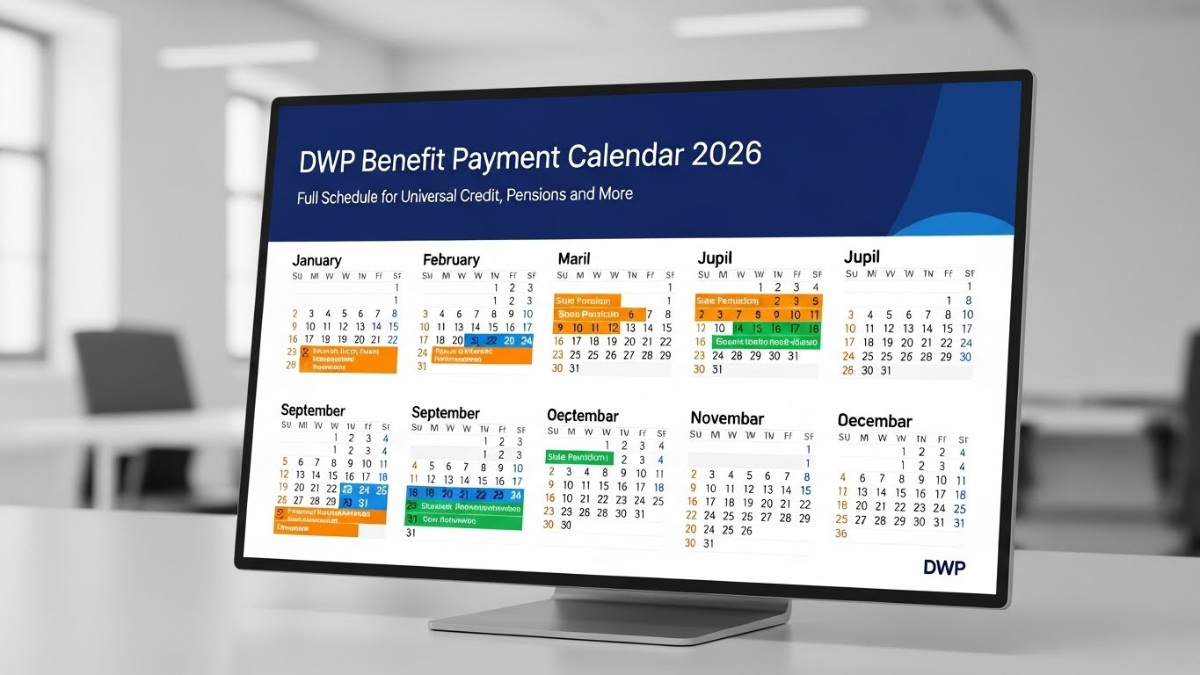

DWP benefit payment calendar 2026 is set to be an essential planning tool for millions of people across the UK who rely on government support for everyday living expenses. From working-age claimants receiving Universal Credit payments to retirees depending on state pensions, knowing when money is due to arrive helps households manage rent, utilities, food, and other essential costs. As cost-of-living pressures remain a concern, clarity around pension dates and benefit schedules is more important than ever. The DWP benefit payment calendar 2026 provides structure and predictability, helping claimants plan their finances with confidence throughout the year.

Understanding The DWP Benefit Payment Calendar 2026

The DWP benefit payment calendar 2026 outlines when different benefits are scheduled to be paid during the year, taking into account weekends and public holidays. Payments managed by the Department for Work and Pensions are usually made on specific days of the week, but adjustments are common when scheduled dates fall on non-banking days. This is particularly relevant for Universal Credit payments, which are typically paid monthly, and for fixed pension dates that many retirees depend on.

Understanding how the DWP benefit payment calendar 2026 works helps claimants avoid confusion and unnecessary stress. While the payment frequency for most benefits remains consistent, the exact date can shift slightly. These adjustments ensure that recipients are not left waiting when banks are closed, maintaining continuity of income.

Universal Credit Payments In 2026

For many households, Universal Credit payments form the core of monthly income. Under the DWP benefit payment calendar 2026, Universal Credit continues to be paid monthly, usually on the same date each month based on the original claim. However, when payment dates fall on weekends or public holidays, payments are typically made earlier.

This predictability allows claimants to align rent, bills, and other commitments with Universal Credit payments. Budgeting becomes easier when recipients understand how the DWP benefit payment calendar 2026 accommodates bank holidays. Claimants are encouraged to track their payment dates carefully, especially during months with major public holidays, as timing shifts can affect cash flow.

Pension Dates And Retirement Income Planning

Pension dates are a critical component of the DWP benefit payment calendar 2026, particularly for older adults who rely on state pension income. State pensions are usually paid every four weeks, on a specific weekday determined by the recipient’s National Insurance number. This system remains consistent, providing long-term predictability for retirees.

In 2026, pension dates may be brought forward when they coincide with bank holidays, ensuring that pensioners receive funds without delay. For those managing fixed incomes, understanding the DWP benefit payment calendar 2026 helps with planning regular expenses such as housing costs, healthcare, and daily living needs. Clear knowledge of pension dates supports financial stability throughout retirement.

Other Benefits Covered By The 2026 Calendar

Beyond Universal Credit payments and pension dates, the DWP benefit payment calendar 2026 also applies to a range of other benefits. These include disability-related benefits, income support, and carers’ payments. Each benefit has its own payment cycle, but all follow similar rules regarding weekends and public holidays.

Consistency across the system helps reduce administrative complexity and confusion for claimants. By referring to the DWP benefit payment calendar 2026, individuals receiving multiple benefits can better coordinate their finances. This is especially important for households where benefit income forms the majority of monthly resources.

Why Payment Timing Matters For Households

Payment timing under the DWP benefit payment calendar 2026 has a direct impact on household financial health. Delays or misunderstandings about payment dates can lead to missed rent, overdraft fees, or reliance on short-term borrowing. Accurate knowledge of Universal Credit payments and pension dates reduces these risks.

For vulnerable groups, including low-income families and pensioners, even small timing changes can have significant consequences. The structured nature of the DWP benefit payment calendar 2026 is designed to minimize disruption, but awareness remains key. Planning ahead ensures that essential expenses are covered even when payment dates shift.

Managing Budgeting Around The 2026 Payment Schedule

Effective budgeting depends on aligning spending with income. The DWP benefit payment calendar 2026 allows claimants to map out expected income across the year. By noting months where Universal Credit payments or pension dates arrive earlier, households can adjust spending patterns to avoid running short later in the month.

Many recipients choose to set aside funds when payments arrive early to cover longer gaps between payments. Understanding the rhythm of the DWP benefit payment calendar 2026 supports better financial decision-making and reduces reliance on emergency support or credit.

Key Features Of The DWP Benefit Payment Calendar 2026

- Monthly Universal Credit payments with holiday adjustments

- Regular four-week pension dates based on National Insurance numbers

- Early payments when scheduled dates fall on bank holidays

- Consistent structure across multiple DWP benefits

- Greater predictability for household budgeting

Table: Overview Of Common DWP Payment Schedules In 2026

| Benefit Type | Usual Payment Frequency | Adjustment Rule |

|---|---|---|

| Universal Credit | Monthly | Paid earlier on bank holidays |

| State Pension | Every four weeks | Early payment if date falls on holiday |

| Disability Benefits | Weekly or four-weekly | Adjusted for non-banking days |

| Carer Benefits | Weekly | Paid earlier when needed |

| Income Support | Fortnightly | Holiday-based adjustments |

Communication And Staying Informed

The Department for Work and Pensions typically communicates payment information through official letters, online accounts, and benefit statements. Claimants are encouraged to regularly check their accounts to confirm Universal Credit payments and pension dates. Staying informed helps avoid misunderstandings related to the DWP benefit payment calendar 2026.

Digital tools and reminders can also support awareness. By tracking expected payment dates, households can anticipate changes and plan accordingly. Clear communication remains a key part of ensuring that the DWP benefit payment calendar 2026 works effectively for all recipients.

Common Issues And How To Avoid Them

Despite structured schedules, issues can arise if claimants are unaware of changes to the DWP benefit payment calendar 2026. Misinterpreting early payments as extra income or overlooking longer gaps between payments can create budgeting problems. Awareness of Universal Credit payments cycles and pension dates helps prevent these mistakes.

Seeking advice early, reviewing official notifications, and maintaining a basic monthly budget are practical ways to avoid financial strain. The more familiar claimants are with the DWP benefit payment calendar 2026, the better equipped they are to manage income fluctuations.

Conclusion

The DWP benefit payment calendar 2026 plays a crucial role in helping individuals and families manage their finances throughout the year. By clearly outlining Universal Credit payments, pension dates, and other benefit schedules, it provides predictability in an uncertain economic environment. Understanding how payment dates adjust around holidays allows households to budget more effectively and avoid unnecessary stress. With careful planning and awareness, the DWP benefit payment calendar 2026 can be a valuable tool for maintaining financial stability and confidence.

FAQs

What is the DWP benefit payment calendar 2026?

The DWP benefit payment calendar 2026 shows scheduled payment dates for benefits throughout the year.

How often are Universal Credit payments made?

Universal Credit payments are usually made monthly, with adjustments for bank holidays.

How are pension dates decided?

Pension dates are based on National Insurance numbers and paid every four weeks.

What happens if a payment date falls on a holiday?

Payments are generally made earlier to ensure access to funds.

Why is it important to track the payment calendar?

Tracking the DWP benefit payment calendar 2026 helps households budget and avoid financial disruption.

Click here to learn more