The upcoming revision of the UK Minimum Wage 2026 marks one of the most significant wage adjustments in recent years, reflecting ongoing efforts to support workers amid rising living costs. As inflation, housing expenses, and overall consumer prices continue to shape daily life across the United Kingdom, it has become essential to update earnings standards to maintain fair compensation. Workers, employers, and policymakers alike are turning their attention to the updated Hourly wage rates UK structure to understand how the changes will impact income, business costs, and employment patterns.

Each year, wage policies undergo review to ensure alignment with economic conditions and workforce needs. However, 2026 stands out as a critical year due to broader economic pressures and the government’s emphasis on supporting low- and middle-income groups. The adjustments outlined under the UK Minimum Wage 2026 update aim to provide workers with wages that better reflect actual living requirements while promoting fairness and productivity within organizations.

This comprehensive guide explains the latest wage changes, breaks down the updated hourly rates by age category, and examines what these shifts mean for workers and employers across the country. Whether you are planning workforce budgets, preparing for payroll changes, or simply want to understand how your income may shift, staying informed about the new Hourly wage rates UK is essential for navigating 2026’s economic landscape.

Why the UK Minimum Wage Increase Matters

The adjustments under the UK Minimum Wage 2026 are designed to support workers faced with rising costs of essentials like food, transportation, rent, and energy. As inflation trends continue to evolve, wage updates serve as a necessary response to sustain purchasing power and reduce economic strain. This ensures that workers across different fields maintain access to a decent standard of living.

Moreover, modern wage policy is closely tied to broader social goals. Increasing minimum wages reduces income inequality, strengthens workforce morale, and encourages stronger long-term employment engagement. Employers who proactively adopt updated standards often benefit from improved retention and enhanced productivity. This relationship highlights why revised Hourly wage rates UK are not just numbers—they are strategic tools for building sustainable economic systems.

Another reason the 2026 wage increase is significant is its impact on younger workers who often enter the workforce at lower wage brackets. By raising hourly rates for each age group, the government aims to provide equitable opportunities and support financial independence among young employees. As a result, the updated UK Minimum Wage 2026 framework creates opportunities for growth and improved job stability.

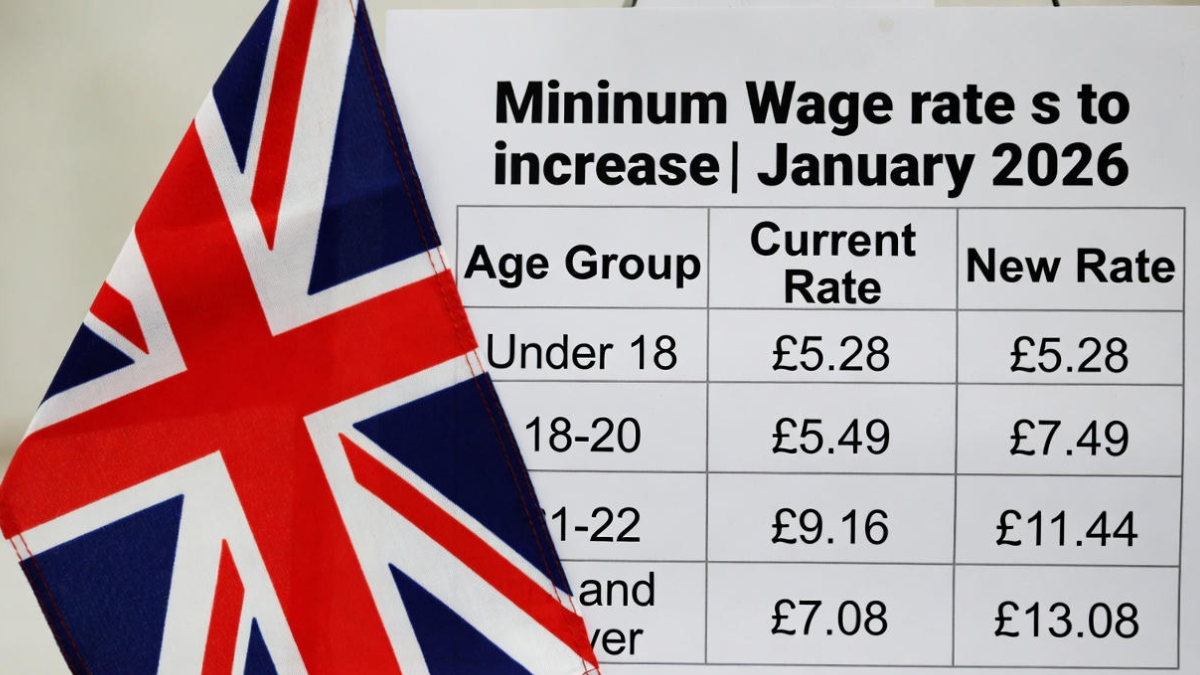

Updated Hourly Wage Rates by Age Group (2026)

To provide transparency and clarity, below is the updated Hourly wage rates UK table effective January 2026. These figures reflect government recommendations and wage commission reviews.

| Age Group / Category | 2025 Rate (per hour) | 2026 Updated Rate (per hour) | Increase |

|---|---|---|---|

| Workers aged 21+ | £11.44 | £12.20 | +£0.76 |

| Workers aged 18–20 | £8.60 | £9.10 | +£0.50 |

| Workers aged 16–17 | £6.40 | £6.85 | +£0.45 |

| Apprentices | £6.40 | £6.90 | +£0.50 |

| National Living Wage (expanded category) | £11.44 | £12.20 | +£0.76 |

These increases reflect the government’s commitment to ensuring that every worker receives a fair and sustainable wage. The revised UK Minimum Wage 2026 aims to strengthen financial security while supporting economic growth. By raising the floor for wages nationwide, the system encourages stability not only for workers but also for businesses planning long-term operations.

Impact of the Wage Increase on Workers and Employers

Workers across the country can expect noticeable improvements in their monthly earnings following the updated Hourly wage rates UK. This is particularly beneficial for individuals engaged in part-time, shift-based, and entry-level positions where hourly wages create a direct and immediate impact on financial well-being. The rise in wages helps cover everyday needs and reduces reliance on supplemental financial assistance.

For employers, however, the adjustments come with considerations. Businesses—especially small enterprises—must plan strategically to accommodate increased labor costs. The UK Minimum Wage 2026 update may require organizations to adjust workforce planning, automation strategies, staffing levels, or even pricing models. While these changes may pose challenges, they also encourage companies to optimize workflows and invest in employee skill development to improve productivity.

In many cases, wage increases can lead to higher job satisfaction and reduced turnover, ultimately benefiting employers. Businesses that embrace the updated Hourly wage rates UK often report improved employee morale and stronger retention rates. Over time, these advantages support more stable and resilient organizational structures.

Preparing for the 2026 Wage Changes

Workers and employers must proactively prepare for the implementation of the UK Minimum Wage 2026 update. Employees should review their current contracts, understand their wage category, and ensure their pay aligns with the updated requirements. Being aware of wage entitlements empowers workers to engage in informed conversations with employers and better plan their financial future.

Employers, on the other hand, should begin by assessing their payroll systems, staffing budgets, and operational workflows. Early planning helps minimize disruptions once the new Hourly wage rates UK take effect. Companies should also communicate changes clearly to staff, ensuring transparency and maintaining trust.

Training programs, productivity tools, and strategic scheduling may become essential components of adapting to updated wage structures. By taking these steps, businesses can support compliance while encouraging an efficient and motivated workforce.

Conclusion

The UK Minimum Wage 2026 update represents a critical step forward in strengthening labor standards and supporting economic resilience. With the revised Hourly wage rates UK offering clearer and more equitable wage structures, workers are better positioned to meet rising living costs and achieve financial stability. Employers, too, can benefit from the long-term improvements in employee engagement and workplace productivity that come with fair compensation. By staying informed and preparing ahead, both workers and organizations can navigate the new wage landscape with confidence and success.

FAQ

What is the new minimum wage for workers aged 21 and above in 2026?

The updated rate for workers aged 21+ is £12.20 per hour.

Why is the UK Minimum Wage increasing in 2026?

The increase aims to address rising living costs and improve income fairness across the workforce.

Do apprentices also receive a wage increase?

Yes, apprentices will see their hourly rate rise to £6.90 under the updated structure.

When will the new wage rates take effect?

The UK Minimum Wage 2026 update becomes effective in January 2026.

Will employers need to adjust their payroll systems?

Yes, employers should update payroll processes to ensure compliance with the new Hourly wage rates UK.

Click here to learn more