The $3267 Worker Benefit Singapore program is emerging as one of the most anticipated financial support initiatives under the broader framework of Singapore benefits 2026. Designed to strengthen income stability for lower- and middle-income workers, this benefit aims to provide direct cash relief at a time when living costs, housing expenses, and healthcare needs continue to rise. As policymakers plan forward-looking welfare measures, the $3267 Worker Benefit Singapore reflects a growing focus on workforce sustainability and economic inclusion. Through carefully structured eligibility rules and digital application processes, Singapore benefits 2026 are expected to offer timely support to thousands of households. Understanding how this program works is essential for anyone aiming to benefit from the upcoming financial assistance.

Purpose of the Worker Benefit and Who It Is Designed For

The core objective of the $3267 Worker Benefit Singapore is to offer direct financial assistance to workers who fall within defined income and employment brackets. Under the umbrella of Singapore benefits 2026, this scheme is targeted primarily at residents employed in essential and service-based sectors where wage growth may lag behind inflation. The government intends this benefit to reduce financial stress while encouraging long-term workforce participation. Unlike one-time emergency relief efforts, the $3267 Worker Benefit Singapore is structured as part of a broader economic stabilization approach within Singapore benefits 2026, aiming to strengthen household resilience. It also reflects Singapore’s policy direction of balancing economic competitiveness with social protection for working citizens.

Eligibility Requirements and Payment Structure

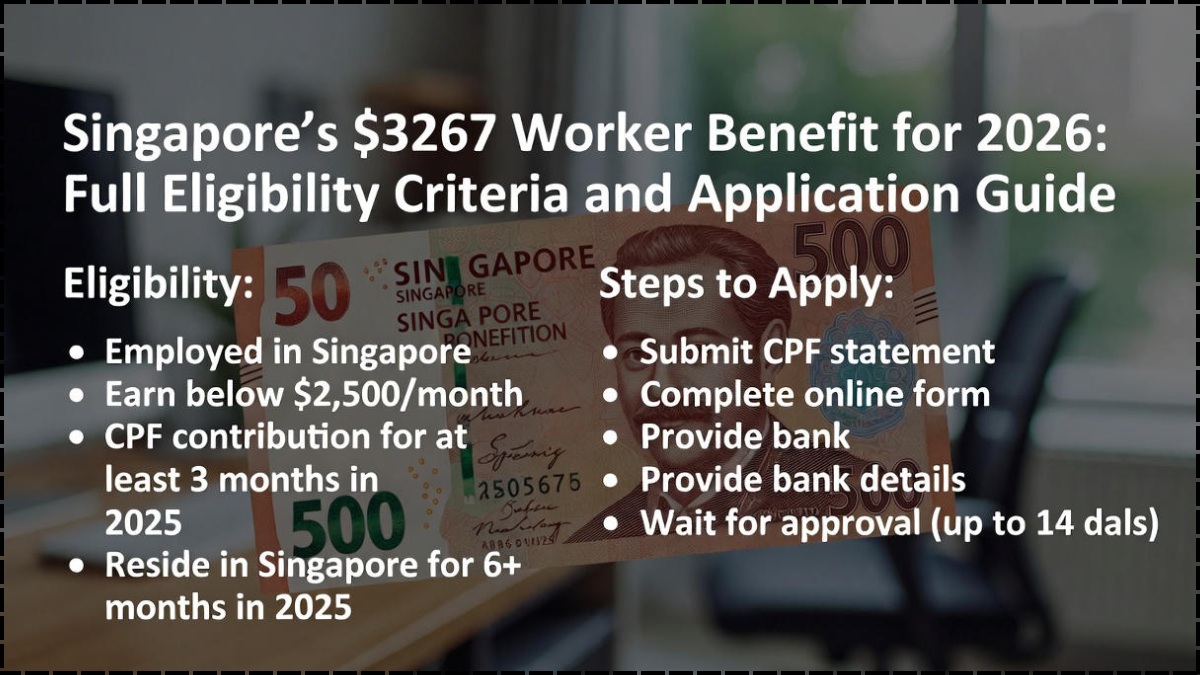

To qualify for the $3267 Worker Benefit Singapore, applicants are expected to meet specific criteria related to citizenship, income levels, employment status, and residency. These eligibility checks ensure that Singapore benefits 2026 reach those who need it the most. While final rules may evolve closer to the rollout, the expected structure is carefully designed to promote fairness and financial accountability.

Here is a simplified table outlining the expected eligibility and benefit structure:

| Category | Expected Requirement | Benefit Status |

|---|---|---|

| Citizenship | Singapore citizen | Mandatory |

| Monthly Income | Within lower to middle-income threshold | Mandatory |

| Employment Status | Full-time or eligible part-time worker | Mandatory |

| Age Group | 21 years and above | Mandatory |

| Property Ownership | Limited to one residential property | Conditional |

| Disbursement Mode | Direct bank credit or government-linked digital wallet | Standard |

Under Singapore benefits 2026, this benefit may be disbursed as a one-time lump sum or in flexible phases based on household income conditions. The $3267 Worker Benefit Singapore payment structure ensures that eligible residents receive timely assistance without unnecessary administrative delays.

Application Process and Required Documentation

The application process for the $3267 Worker Benefit Singapore is expected to follow a fully digital-first approach under the national e-services platform used for Singapore benefits 2026. Eligible applicants will likely be notified automatically if they meet all pre-verified criteria through government-linked employment and income records. However, manual applications may also be available for individuals whose income sources require additional validation.

Applicants should be prepared with supporting documents such as proof of employment, recent income statements, CPF contribution records, and residential verification. Once submitted, applications for the $3267 Worker Benefit Singapore will typically go through an automated verification stage, followed by a brief manual review if needed. The structured design within Singapore benefits 2026 helps ensure that the process remains transparent, secure, and efficient for all applicants.

Economic Impact and Long-Term Significance for Workers

Beyond short-term relief, the $3267 Worker Benefit Singapore plays a strategic role in strengthening long-term economic stability for the working population. Within the wider scope of Singapore benefits 2026, this initiative supports domestic consumption, reduces dependency on high-interest short-term credit, and enhances workforce morale. For many low- and middle-income households, the $3267 Worker Benefit Singapore can help offset rising utility costs, educational expenses for children, and healthcare needs for elderly family members. By reinforcing worker confidence and reducing financial vulnerability, Singapore benefits 2026 aim to build a more inclusive and resilient economic environment that benefits both employees and employers.

Conclusion

The $3267 Worker Benefit Singapore stands out as a vital financial support measure under the evolving framework of Singapore benefits 2026. By combining targeted eligibility, streamlined digital applications, and direct cash disbursement, this program reflects Singapore’s continued commitment to workforce protection in a changing economic climate. For eligible residents, the $3267 Worker Benefit Singapore offers not only immediate relief but also long-term financial stability. As details continue to solidify, staying informed about Singapore benefits 2026 will be essential for workers seeking to maximize their financial security in the coming year.

FAQs

Who is eligible for the $3267 Worker Benefit Singapore?

Eligibility generally depends on Singapore citizenship, income range, employment status, age, and property ownership conditions as defined under Singapore benefits 2026.

How will the payment of the $3267 Worker Benefit Singapore be made?

The payment is expected to be credited directly to the beneficiary’s registered bank account or approved digital payment platform.

Is the $3267 Worker Benefit Singapore a one-time payment?

While currently projected as a one-time benefit, future adjustments may introduce phased disbursements under Singapore benefits 2026.

Do workers need to apply manually for the $3267 Worker Benefit Singapore?

Many eligible residents may be auto-enrolled, but some may still need to apply manually if their income records require verification.

When will the $3267 Worker Benefit Singapore be distributed?

Distribution is expected to take place within the official rollout window of Singapore benefits 2026, once final approvals are announced.

Click here to learn more